🌈 Complete Family Well-being!

A novice-friendly Guide to Holistic Family Wellness and Well-being, India-centric - Building Thriving Lives Together!

🌈 Complete Family Well-being!

The definitive comprehensive guide for Indian families covering all 8 dimensions of well-being, OCEAN personality insights, relationship wisdom, financial planning, and practical transformation plans. Everything you need to build a thriving family life - rooted in Indian culture, backed by science, proven by families like yours.

🙏 Welcome Home

Dear Family,

Whether you’re a grandparent seeking purpose, a parent juggling everything, a young couple building your life, a young adult finding your path, or a child growing up - this guide is for every single one of you.

Whether joint family or nuclear, ₹20,000 salary or ₹2 lakhs, Hindu or Muslim or Christian or Sikh or secular - this speaks to your reality.

Because thriving isn’t about perfect conditions. It’s about understanding what matters, working together, and taking small daily steps.

What you’ll find here:

- Complete 8-dimension wellness framework

- Practical strategies for each family member

- Financial freedom (50-30-20 rule explained)

- Relationship harmony and communication skills

- OCEAN personality insights

- 90-day transformation plans

- Emergency protocols and resources

- 50+ real-world FAQs

Let’s begin your family’s wellness journey. 🌺

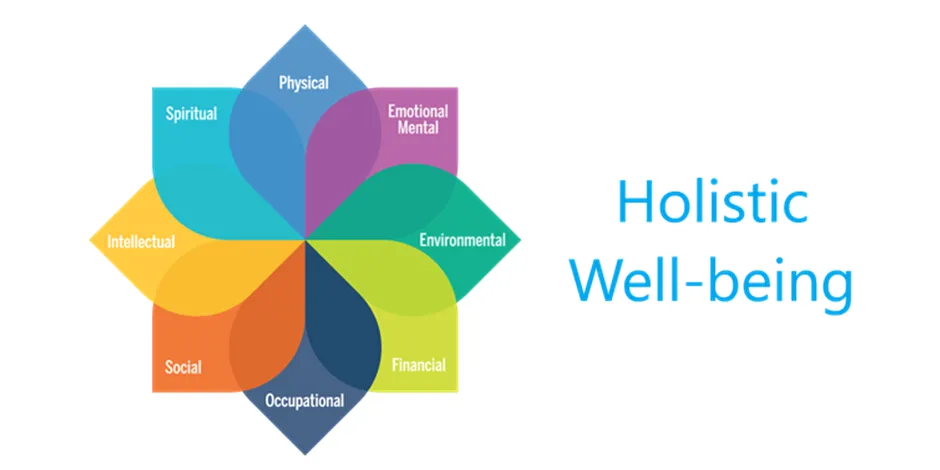

PART 1: The 8 Dimensions Framework

🌟 Understanding Holistic Family Wellness

Imagine your well-being as a wheel with 8 spokes. Break even one - the whole wheel wobbles.

You might earn well (financial ✓) but if your marriage struggles (social ✗), you’re not thriving. You might be fit (physical ✓) but drowning in anxiety (mental ✗) - life still feels hard.

This is why holistic wellness matters.

The 8 Dimensions Explained

1. 💪 Physical Well-being

Your body - health, fitness, nutrition, sleep, energy.

Why it matters: Without physical health, everything else suffers. Medical bills drain finances. Illness prevents working. Poor health affects mood.

Indian context: Managing diabetes/BP, home cooking vs processed foods, affordable healthcare.

2. 🧠 Mental/Emotional Well-being

Your mind - mental health, stress management, emotional regulation, happiness.

Why it matters: Mental health affects EVERYTHING - relationships, work, physical health, decisions.

Indian context: Stigma (“therapy is for crazy people”), “log kya kahenge,” competitive pressure, family expectations.

3. 🕉️ Spiritual Well-being

Your purpose - meaning, values, connection to something greater.

Why it matters: Without meaning, even success feels empty. Purpose sustains through tough times.

Indian context: Rich spiritual traditions (all faiths), daily practices (puja/namaz/prayer), finding faith without rigidity.

4. 📚 Intellectual Well-being

Your mind’s growth - learning, curiosity, creativity, staying engaged.

Why it matters: Stagnation leads to boredom and dissatisfaction. Learning keeps you relevant and fulfilled.

Indian context: Valuing education but often narrowly; lifelong learning beyond degrees; creativity beyond academics.

5. 👥 Social Well-being

Your relationships - family, friends, community, support systems.

Why it matters: Isolation literally kills. Strong relationships = better health, longer life, more happiness.

Indian context: Joint families, in-laws, community importance, “log kya kahenge,” balancing independence and interdependence.

6. 💼 Occupational Well-being

Your work - career satisfaction, work-life balance, meaning in what you do.

Why it matters: You spend huge portion of life working. Dissatisfaction affects everything else.

Indian context: Job pressure, long hours, undervaluing homemakers, competitive market, job security concerns.

7. 💰 Financial Well-being

Your money - living within means, savings, emergency preparedness, security.

Why it matters: Money stress = #1 cause of family conflict. Financial insecurity = chronic anxiety.

Indian context: Supporting multiple generations, dowry, EMIs, festival expenses, medical emergencies, retirement.

8. 🌿 Environmental Well-being

Your surroundings - living space, cleanliness, organization, nature connection.

Why it matters: Environment affects mood, health, productivity. Clutter creates mental clutter.

Indian context: Urban pollution, small spaces (joint families), limited green access, waste management.

📊 Complete Family Wellness Assessment

Instructions:

- Each family member fills individually

- Be honest (for YOU, not for show)

- Rate 1-10 on each question

- Calculate dimension scores

- Discuss as family

💪 PHYSICAL WELL-BEING

Rate yourself 1-10:

- I exercise 30+ minutes, 3-4x/week ___

- I eat balanced, home-cooked meals ___

- I get 7-8 hours quality sleep ___

- I maintain healthy weight ___

- I have regular check-ups ___

- I feel energetic daily ___

- I manage chronic conditions well ___

- I avoid harmful habits ___

- I drink 6-8 glasses water daily ___

- I’m pain-free or manage it well ___

**Physical Score: __/100** (÷10 = __/10)

🧠 MENTAL/EMOTIONAL WELL-BEING

Rate yourself 1-10:

- I manage daily stress well ___

- I feel generally happy ___

- I can express emotions appropriately ___

- I have coping strategies ___

- Worries don’t dominate my thoughts ___

- I feel confident handling challenges ___

- I maintain positive outlook ___

- I can relax without guilt ___

- I’m not constantly overwhelmed ___

- I’d seek help if needed without shame ___

**Mental Score: __/100** (÷10 = __/10)

🕉️ SPIRITUAL WELL-BEING

Rate yourself 1-10:

- I have clear sense of purpose ___

- I practice regularly (prayer/meditation) ___

- I feel connected to something larger ___

- My values guide my decisions ___

- I experience inner peace regularly ___

- I find comfort in faith/spirituality ___

- I practice gratitude ___

- Life has meaning beyond material success ___

- I’m at peace with my beliefs ___

- I contribute to causes larger than myself ___

**Spiritual Score: __/100** (÷10 = __/10)

📚 INTELLECTUAL WELL-BEING

Rate yourself 1-10:

- I’m actively learning new things ___

- I engage in mentally stimulating activities ___

- I’m curious about new ideas ___

- I engage in creative activities ___

- I have engaging conversations ___

- I seek knowledge opportunities ___

- I feel intellectually engaged ___

- I’m open to changing my mind ___

- I learn for its own sake ___

- I’m not mentally stagnant ___

**Intellectual Score: __/100** (÷10 = __/10)

👥 SOCIAL WELL-BEING

Rate yourself 1-10:

- I have meaningful relationships ___

- I communicate openly with close ones ___

- I have people I can count on ___

- I feel connected to family/community ___

- I maintain healthy boundaries ___

- I contribute positively to others ___

- I don’t feel lonely ___

- My relationships are reciprocal ___

- I handle conflicts constructively ___

- I spend quality time with loved ones ___

**Social Score: __/100** (÷10 = __/10)

💼 OCCUPATIONAL WELL-BEING

Rate yourself 1-10:

- I find meaning in my work/activities ___

- I have work-life balance ___

- My skills are being used well ___

- I’m satisfied overall ___

- Work doesn’t cause excessive stress ___

- I have growth opportunities ___

- My efforts are recognized ___

- I don’t dread work ___

- Work aligns with my values ___

- I can disconnect and relax ___

**Occupational Score: __/100** (÷10 = __/10)

💰 FINANCIAL WELL-BEING

Rate yourself 1-10:

- I live within my means ___

- I have and follow a budget ___

- I save regularly ___

- I have emergency fund ___

- I don’t lose sleep over money ___

- I’m progressing toward financial goals ___

- I know where money goes ___

- I’m not drowning in debt ___

- I’m confident making financial decisions ___

- I’m preparing for future needs ___

**Financial Score: __/100** (÷10 = __/10)

🌿 ENVIRONMENTAL WELL-BEING

Rate yourself 1-10:

- My living space is clean and organized ___

- I feel comfortable and peaceful at home ___

- I spend time in nature regularly ___

- My home is clutter-free ___

- I have space to relax ___

- My environment supports well-being ___

- I practice sustainability ___

- I’m not stressed by surroundings ___

- I can control noise and have quiet time ___

- My neighborhood feels safe ___

**Environmental Score: __/100** (÷10 = __/10)

🎯 Interpreting Your Results

Individual Dimension Scores:

9-10: Excellent! Maintain.

7-8: Good! Minor optimization.

5-6: Needs improvement. Moderate priority.

3-4: Concerning. High priority.

1-2: Crisis. Seek help + immediate action.

Overall Wellness Score:

Add all 8 scores = ___/80

72-80: Thriving excellently!

60-71: Good foundation. Focus on lowest 2-3.

48-59: Mixed. Prioritize lowest 3-4.

36-47: Struggling. Focus on 2 dimensions intensely + get support.

Below 36: Crisis mode. Professional help needed + use this guide.

👨👩👧👦 Family Wellness Meeting

30-45 minutes for this crucial conversation:

Ground Rules:

- No judgment

- No fixing (just understanding)

- No comparison

- Respect

- Confidentiality

Discussion:

- Share your overall score

- Which dimension surprised you?

- What’s your lowest? Why?

- What’s your highest? How?

- Where do our low scores overlap? (family priorities!)

- What’s ONE thing each person commits to this month?

- How can we support each other?

Identify 3 family priority dimensions based on discussion.

🚀 Starting Your Wellness Journey

The Golden Rule:

“Start ridiculously small. Be absurdly consistent.”

Most fail because they try changing everything: ❌ Join gym! Meal prep! Meditate 1 hour! Save ₹10,000!

Instead - The 1% Improvement Method:

- Pick #1 priority dimension

- Choose SMALLEST daily action (5-10 min)

- Do it 30 days straight

- Then add next small action

Example: Financial priority

- Month 1: Track expenses daily (5 min app)

- Month 2: Auto-debit ₹1,000 savings + track

- Month 3: Review budget weekly + previous actions

- Month 4: Pack lunch 3x/week + all previous

Result by Month 4: Saving ₹2,500+/month from tiny daily actions!

📋 Your First Week Action Plan

Pick #1 priority: _______

Choose ONE tiny action:

Physical: □ 10-min walk after dinner

□ 10 push-ups + squats morning

□ Drink 8 glasses water

□ Sleep/wake same time

Mental: □ 5-min breathing (4-4-4)

□ Write 3 gratitudes before bed

□ 10-min phone-free time

□ One compliment to family member

Spiritual: □ 5-min prayer/meditation

□ Read 1 page spiritual text

□ Express gratitude for 3 things

□ One act of kindness

Intellectual: □ Read 10 pages

□ Learn one new word/fact

□ Watch 15-min educational video

□ Engaging family conversation

Social: □ 15-min phone-free family time

□ One meaningful question to family

□ Text/call one friend weekly

□ Dinner together (phones away)

Occupational: □ Set 3 priorities each morning

□ 5-min break every hour

□ Leave work at specific time

□ End-of-day reflection (3 accomplishments)

Financial: □ Track every rupee (Walnut app)

□ Save first ₹500-1000 on salary day

□ Pack lunch 2x/week

□ No impulse purchases (24-hour rule)

Environmental: □ Make bed every morning

□ 10-min evening tidy

□ Declutter one item daily

□ 15 min in balcony/park

Commit for 7 days. Mark calendar. Tell someone.

PART 2: Deep Dive - Physical & Mental Well-being

💪 Physical Well-being - Your Foundation

Understanding in Indian Context

Physical wellness is THE foundation. Yet Indian families face:

- Sedentary lifestyles (desk jobs, commutes)

- Processed foods replacing home cooking

- Healthcare costs (#1 cause of debt)

- Chronic conditions (diabetes/heart disease capital)

- Work culture (long hours, poor balance)

- Joint family cooking (hard to eat differently)

Good news: Indian traditional wisdom (yoga, Ayurveda) + modern science = powerful accessible strategies.

For Each Family Member

👴👵 Grandparents/Seniors (60+)

Challenges: Chronic conditions, reduced mobility, medication management, fear of being burden, fixed income, loneliness.

Strategies:

Exercise (30 min daily, doctor-approved):

- Morning walks (20-30 min, with friend for social+physical!)

- Chair yoga (YouTube videos)

- Pranayama (Anulom Vilom, Kapalbhati - 15 min reduces BP)

- Gentle stretching

- Household tasks (gardening, light cleaning)

Nutrition:

- Protein crucial (dal, eggs, paneer, yogurt)

- Calcium (milk, ragi, sesame)

- Fiber (vegetables, whole grains)

- Hydration (6-8 glasses)

- Limit salt

Health Management:

- Regular check-ups (every 3-6 months)

- Pill box organizer

- Ayushman Bharat (free insurance if eligible: pmjay.gov.in)

- Jan Aushadhi medicines (50-90% cheaper!)

Success Story: Ramesh Uncle (68, Pune) - Type 2 diabetes, sedentary. Started 20-min walks with neighbor, chair yoga 3x/week, Jan Aushadhi medicines. 6 months: HbA1c 8.5→6.9, lost 7kg, new friends, reduced medicine dosage! Cost: ₹0 exercise, saved ₹3,000/month medicines!

👨💼👩💼 Parents (35-60)

Challenges: Work+home+aging parents+children = exhausted. Sitting 8-10 hours. Stress eating. Weekend warrior syndrome.

Exercise (30-40 min, 4-5x/week):

No gym needed:

- Morning 15-min routine:

- 50 jumping jacks

- 20 push-ups

- 30 squats

- 1-min plank

- Repeat 3x

- Lunchtime walk (15 min)

- Evening family activity (30 min)

- Staircase workout

- YouTube workouts (Cult.fit, FitTuber Hindi)

Nutrition:

- Sunday meal prep

- Breakfast non-negotiable (even 10 min)

- Pack lunch (saves ₹3,000/month + healthier!)

- Dinner by 8pm

- Healthy snacks ready

Work health:

- Stand every hour (alarm)

- Desk exercises

- 20-20-20 eye rule

- Water at desk

Success Story: Priya Madam (42, Delhi) - IT, sitting 10 hours, gained 15kg, pre-diabetic. Started lunch walks, YouTube workouts 20 min 3x/week, packed lunch. 8 months: Lost 12kg, blood sugar normalized, energy up, inspired team! Investment: ₹0, just reorganized time.

👫 Young Couples (25-35)

Challenges: Adjusting to each other, irregular schedules, eating out, work pressure, pre-conception health if planning family.

Exercise together:

- Morning yoga (20 min)

- Evening walks/runs

- Badminton/sports weekends

- Couples gym

- Dance at home (Bollywood 30 min!)

Nutrition:

- Meal planning together

- Cooking together (bond + share responsibility)

- Batch cooking

- Eating out budget (2-3x/month saves ₹6,000)

- Healthy swaps

Pre-conception health:

- Folic acid (women, 3 months before trying)

- Healthy weight (both)

- Exercise routine

- No smoking/alcohol

- Doctor consultation

Success Story: Rahul & Neha (28&26, Bangalore) - Both tech, eating out 15x/month, gaining weight, no exercise. Sunday meal prep together, morning yoga, eating out 4x/month. 6 months: Lost 8kg combined, saved ₹6,000/month, better energy, improved relationship, Neha’s PCOS improved!

🧑🎓 Young Adults (18-25)

Challenges: Hostel food, irregular sleep, exam stress, limited budget, excessive screen time, body image pressure.

Exercise (budget-friendly):

- YouTube workouts (free)

- College gym (usually free/cheap)

- Sports clubs

- Running/jogging (zero cost)

- Hostel room workouts

Nutrition on budget:

- Hostel food: dal-sabzi-roti > fried

- Fruits in room (bananas, apples)

- Boiled eggs (₹5/egg vs ₹50 Maggi!)

- Roasted chana (₹20/packet)

- Water bottle (avoid sugary drinks)

Managing exam stress:

- Study breaks (25-min study, 5-min move)

- Walk while memorizing

- Breathing before exam (5 min calms nerves)

- Sleep non-negotiable (7 hours even during exams)

Success Story: Aditya (21, Mumbai hostel) - Gained 12kg first year, Maggi 2x/day, sleeping 4am, no exercise. Pre-diabetic scare! Switched to mess food, morning jog 30 min, sleep 11pm, YouTube workouts. 1 year: Lost 15kg, blood sugar normal, better grades, jogging friends, confident! Saved money!

👦👧 Children & Teens (8-17)

Challenges: Academic pressure, screen addiction, junk food, sedentary lifestyle, body image, sleep deprivation.

Physical activity (60 min daily - WHO):

- School sports

- Outdoor play (30 min minimum after school!)

- Cycling/skating

- Dance classes

- Martial arts

- Family activities (badminton, cricket, swimming)

Nutrition:

- Healthy breakfast mandatory

- Tiffin packing (homemade)

- Limit junk (treat 2x/week not daily)

- Fruits available

- Involve in cooking

Screen time limits:

- Under 10: Max 1 hour/day

- Teens: Max 2 hours recreational

- No screens during meals (family rule!)

- No screens 1 hour before bed

- Alternatives: board games, reading, outdoor play

Sleep:

- Age 8-12: 9-10 hours

- Age 13-17: 8-9 hours

- Consistent time (even weekends)

- Homework deadline 9pm (protect sleep!)

Success Story: Aarav (14, Hyderabad) - Overweight, phone constantly, poor grades, bullied. Family walks (everyone!), screen limit 2 hours, taekwondo class, healthy tiffin. 1 year: Lost 10kg, black belt yellow stripe, grades improved, bullying stopped, confidence soared! Investment: ₹3,000/month taekwondo (worth every paisa).

Common Challenges + Solutions

“No time for exercise”

- 5:30am wake up, 30-min workout, done!

- Lunch break 15-20 min walk

- Active commute

- Family time = active time

- Micro-workouts (10 squats every hour)

“Gym too expensive”

- Bodyweight exercises (zero cost!)

- YouTube (thousands free)

- Outdoor activities (parks free!)

- Household items as weights

- Government facilities (outdoor gyms)

“Healthy food expensive” MYTH BUSTED!

- Dal: ₹100-150/kg, protein-rich

- Seasonal vegetables: ₹20-40/kg

- Eggs: ₹5-7 each, best protein

- Bananas: ₹40-60/dozen

- Home roti: Cheaper than bread

Expensive ≠ healthy! Home dal-rice-sabzi = healthiest + cheapest!

“Joint family, can’t eat differently”

- Modify portions (same food, less roti, more sabzi)

- Add on side (salad, extra dal)

- Cook base same, customize individual

- Be the change (family may follow!)

- Medical framing (“Doctor said reduce salt”)

Physical Wellness Action Plan

Daily: □ 30 min activity

□ 8 glasses water

□ 3 healthy meals

□ 7-8 hours sleep

□ Stretch breaks

Weekly: □ 3-4 structured exercise

□ Meal planning

□ Weight check

□ Outdoor family activity

Monthly: □ Review routine

□ Weigh-in

□ Medicine check

□ New healthy recipe

Yearly: □ Health check-up everyone

□ Vaccinations update

□ Dental check

□ Eye test

□ Insurance review

🧠 Mental/Emotional Well-being

Breaking the Stigma

Reality: Mental health is HEALTH.

- 1 in 7 Indians has mental health issues

- Suicide: Leading death cause 15-29 age

- 70-92% receive NO treatment

Why stigma? “Log kya kahenge,” weakness confusion, marriage/career fears, limited access.

Truth: Seeking help = strength. Therapy = maintenance. Everyone benefits.

For Each Family Member

👴👵 Grandparents

Challenges: Depression (often undiagnosed - “old age hai”), loneliness, loss of purpose, grief, anxiety about dependency.

Signs of elderly depression:

- Physical complaints despite normal tests

- Irritability more than sadness

- Loss of interest

- Sleep/appetite changes

- Memory complaints

- “Tired of living”

Strategies:

Social connection (CRUCIAL):

- Senior citizen groups

- Volunteer work

- Teach grandchildren

- Video calls

- Neighborhood friendships

Purpose:

- Hobbies renewed

- Teaching role

- Spiritual deepening

- Writing memoirs

Professional help works for elderly too!

Success Story: Lakshmi Amma (72, Chennai) - Depressed after husband’s death, stopped eating. Started morning walks with senior group, volunteered reading to blind seniors, therapy, taught grandchildren cooking. 6 months: Smiling, appetite back, life has meaning! “I thought life over. It was new chapter beginning.”

👨💼👩💼 Parents

Challenges: Burnout, sandwich generation stress, work pressure, relationship stress, financial anxiety, guilt, sleep deprivation.

Burnout signs:

- Exhaustion rest doesn’t fix

- Cynicism

- Feeling ineffective

- Physical symptoms

- Emotional numbness

- Dreading work/home

Strategies:

Boundaries (non-negotiable!):

- Set work end time (7pm = 7pm. Laptop closes.)

- Communicate limits

- Use leave

- Say no

- Commute transition (10-min decompress)

Stress management:

- Daily decompression (15 min alone)

- Exercise (30 min daily)

- Breathing (5 min morning/evening)

- Hobby weekly

- Social monthly (not just family!)

Relationship:

- Couple time weekly (30 min minimum)

- Date night monthly

- Daily communication (15 min real talk)

- Express appreciation

- Physical affection

Success Story: Amit (42, Mumbai) - Software, 12-hour days, pre-diabetic, marriage struggling, snapping at kids, doctor recommended antidepressants. Changes: Hard boundary (work ends 6:30pm NO exceptions), weekly therapy, morning gym, biweekly date night. 8 months: Promoted (better productivity fewer hours!), marriage healing, diabetes improving, no medication, kids say “Papa fun now!” Investment: ₹4,000/month therapy (worth every paisa).

👫 Young Couples

Challenges: Adjustment, in-law pressure, work-life balance, financial stress, fertility anxiety, conflicts, identity balance.

Strategies:

Communication:

- Daily 15-min check-ins

- Weekly relationship meeting

- I-statements (“I feel X when Y”)

- Conflict resolution time (not when angry)

- Daily appreciation

Boundaries:

- United front (decide together, present together)

- Each manages their family

- Privacy boundaries (bedroom, finances, decisions YOURS)

- Scripts ready

Stress together:

- Exercise together

- Hobby time (individual AND together)

- Social life maintained

- Alone time respected

Success Story: Sneha & Vikram (28&30, Pune) - Arranged marriage, constant fighting first year, in-laws interfering, Sneha depressed (new city, no job, isolated), considering separation. Couples therapy, boundaries with in-laws, Sneha hobby class (friends, confidence), weekly dates. 18 months: Strong marriage, pregnant (happened when stress reduced!), own flat nearby, in-laws respect boundaries. “First year hell. Almost gave up. Therapy saved marriage.”

🧑🎓 Young Adults

Challenges: Academic pressure, career anxiety, identity formation, peer pressure, social media anxiety, parental expectations vs desires, relationship issues, financial stress.

Mental health crisis:

- 26% students have depression

- Suicide: Leading death cause this age

- Exam stress: Peak suicide season

- Stigma: Afraid to tell parents

Warning signs:

- Withdrawing

- Grades dropping

- Sleep/appetite changes

- Substance use

- Hopelessness

- Self-harm

- “I wish I was dead”

Strategies:

Academic stress:

- Pomodoro (25 study, 5 break)

- Realistic goals

- Perspective (one exam doesn’t define life!)

- Sleep non-negotiable

- Exercise 30 min

Career anxiety:

- Exploration okay (don’t need life figured out at 20!)

- Try things (internships)

- Skills over degrees

- Mentor

- Therapy/career counseling

Social media health:

- Limit 30-60 min daily

- Curate feed (unfollow negative)

- Reality check (highlight reel not reality)

- FOMO management

- Regular breaks

Success Story: Kavya (21, Delhi University) - Depressed, failing, self-harming, parents didn’t know (afraid they’d “overreact”). Friend noticed, convinced her to college counselor. Depression+anxiety diagnosed. Therapy (college free!), medication, opened to parents (supportive!), reduced course load, joined dance club. One year: Graduated, depression managed, stopped self-harm, relationship with parents better. “Asking for help saved my life.”

👦👧 Children & Teens

Challenges: Academic pressure, peer relationships, bullying, body image, family conflict, technology addiction, emotional regulation, self-esteem.

Warning signs children:

- Regression (bedwetting after being past it)

- Nightmares

- Clinginess or withdrawal

- Appetite changes

- Physical complaints without cause

- School refusal

- Aggression

Warning signs teens:

- Withdrawal

- Grades dropping

- Sleeping too much/little

- Self-harm

- Substance use

- Risk-taking

- Eating disorders

- Suicidal statements

What Parents Can Do:

Emotional safety:

- All feelings okay

- Listen without fixing

- Validate

- Safe expression

Academic pressure reduction:

- Effort praise (“You worked hard!”)

- Grades ≠ worth (“I love you no matter grade”)

- Realistic expectations

- Balance (play, rest matter!)

Bullying response:

- Believe them

- Don’t blame

- Document

- Inform school

- Build confidence

- Therapy if needed

Success Story: Riya (13, Bangalore) - Anxiety, panic attacks before exams, self-harming (scratching), parents shocked when school called. Severe anxiety diagnosed. Child psychologist, family therapy (parents learned reduce pressure), medication short-term, switched schools. 2 years: Anxiety managed, no self-harm 18 months, average student but HAPPY. Parents: “We were pushing to excel. Almost broke her. Her happiness matters more.”

Common Mental Health Challenges

Challenge 1: Stigma

Myths:

- Therapy is for “weak” → Reality: Therapy strengthens mind like gym strengthens muscles

- “I can handle it myself” → Would you fix broken bone yourself? Mental health IS health.

- “What will people think?” → Your mental health > opinions. Also confidential!

Normalizing: Celebrities discuss therapy (Deepika, Anushka). It’s self-investment.

Challenge 2: “Log kya kahenge” anxiety

Reality checks:

- People talk regardless

- Their opinions don’t pay your bills

- They’ll move on (today’s gossip = tomorrow’s forgotten)

- Their judgment reflects THEM

- Can’t please everyone

Actions:

- Information diet (share less with judgmental relatives)

- Develop thick skin (“Interesting perspective”)

- Build support (friends who validate)

- Perspective shift (in 5 years, will this matter?)

Mantra: “Their comfort should not cost my peace.”

Challenge 3: Parental pressure & expectations

For Parents - Self-reflect:

- Are these YOUR dreams or theirs?

- Living through your children?

- Love them for who they are or what they achieve?

Healthy parenting:

- Support THEIR interests

- “What do YOU want?”

- Love unconditionally

- Success defined broadly (happy, fulfilled, good human)

For Adult Children:

- “I appreciate you want best for me. I need my own path.”

- Set boundaries (lovingly but firmly)

- Gradual independence

- Financial independence (harder to control)

- Therapy

Mantra: “I can respect my parents AND live my own life.”

Mental Wellness Action Plan

Daily: □ 10-min mindfulness/meditation

□ Express gratitude (3 things)

□ Exercise

□ Connect meaningfully

□ Acknowledge emotions

□ Limit social media

□ Adequate sleep

Weekly: □ Therapy (if in therapy)

□ Journaling

□ Social time

□ Hobby time

□ Digital detox

□ Nature time

Monthly: □ Mental health check-in

□ Review coping strategies

□ Social media audit

□ Relationship check-in

□ Plan something to look forward to

Yearly: □ Mental health evaluation

□ Life satisfaction assessment

□ Adjust life as needed

□ Therapy even if feeling fine

Resources

Emergency (24/7, Free):

- Vandrevala: 1860-2662-345

- iCall: 9152987821 (Mon-Sat 8am-10pm)

- NIMHANS: 080-46110007

- Sneha: 044-24640050

Online Therapy: BetterLYF, YourDOST, MindPeers, Practo

Apps: Wysa, InnerHour, Headspace, Calm

Warning: Seek Help Immediately If

- Thoughts of suicide/death

- Self-harm

- Severe mood swings

- Hallucinations

- Severe anxiety/panic

- Depression 2+ weeks

- Substance abuse escalating

- Violent thoughts

- Complete withdrawal

- Can’t care for self

Actions:

- Call crisis helpline (1860-2662-345)

- Don’t leave person alone

- Hospital emergency if danger

- Remove means of harm

- Contact mental health professional

Mental health crisis = medical emergency. Treat with urgency!

PART 3: Financial Well-being - Your Money Mastery

💰 Why Financial Wellness Matters

Brutal honesty: Money stress is killing Indian families.

- 70% family conflicts involve money

- #1 cause anxiety/depression in adults

- Medical debt = leading bankruptcy cause

- 80% Indians have NO retirement savings

Tragedy: Most problems preventable with basic knowledge + discipline.

Good news: Financial wellness achievable at ANY income level. Not about how much you earn - how you manage it.

The 50-30-20 Budget Rule

Simplest, most effective budgeting for Indian families.

50% Essentials (needs - must-haves)

30% Lifestyle (wants - nice-to-haves)

20% Savings (future - must-save)

Detailed Breakdown by Income

₹20,000/month (Low Income)

Adjusted: 60-25-15 (essentials cost more proportionally)

Essentials (₹12,000):

- Rent: ₹4,000-5,000

- Groceries: ₹4,000-4,500

- Utilities: ₹800-1,000

- Transport: ₹1,200-1,500

- School: ₹1,000

- Medicine: ₹500

Lifestyle (₹5,000):

- Mobile/Internet: ₹500

- Treats: ₹500

- Festivals: ₹1,000 (save monthly)

- Eating out: ₹500

- Clothing: ₹1,000/month

- Misc: ₹1,500

Savings (₹3,000):

- Emergency fund: ₹2,000

- Future goals: ₹1,000

Money-saving at this level:

- Government schemes (free ration saves ₹500-800)

- Bulk buying (saves ₹500)

- Generic medicines Jan Aushadhi (saves ₹300-500)

- Cook everything (saves ₹2,000+)

- No paid entertainment (YouTube, library)

Possible savings: ₹3,000-4,000/month = ₹36,000-48,000/year!

₹30,000/month

50-30-20 works!

Essentials (₹15,000):

- Rent: ₹6,000-7,000

- Groceries: ₹5,000

- Utilities: ₹1,000

- Transport: ₹1,500

- School: ₹1,500

Lifestyle (₹9,000):

- Mobile: ₹800

- Entertainment: ₹1,000

- Eating out: ₹1,500

- Clothing: ₹1,500

- Festivals: ₹2,000

- Misc: ₹2,200

Savings (₹6,000):

- Emergency fund: ₹3,000

- PPF/Mutual fund: ₹2,000

- Children’s education: ₹1,000

Annual savings: ₹72,000

₹50,000/month

Essentials (₹25,000):

- Rent/EMI: ₹10,000-12,000

- Groceries: ₹6,000

- Utilities: ₹1,500

- Transport: ₹2,500

- School: ₹3,000

Lifestyle (₹15,000):

- Mobile: ₹1,000

- Entertainment: ₹2,000

- Eating out: ₹3,000

- Shopping: ₹3,000

- Hobbies: ₹2,000

- Festivals: ₹2,000

- Misc: ₹2,000

Savings (₹10,000):

- Emergency fund: ₹4,000

- SIP: ₹3,000

- PPF: ₹2,000

- Children’s education: ₹1,000

Annual savings: ₹1,20,000

10 Money-Saving Strategies

1. Cash Envelope Method

- Withdraw cash for lifestyle categories

- Separate envelopes

- Empty = no more spending

- Forces awareness

2. Festival Jar Savings

- Calculate yearly festival expenses

- Divide by 12

- Save monthly

- Ready when festival comes!

3. Bulk Buying

- Rice, dal, oil monthly

- Buy during sales

- Store properly

Savings: 15-20% (₹800-1,200/month)

4. Home Cooking Revolution

Comparison:

- Office lunch outside: ₹150-200/day = ₹3,000-4,000/month

- Packed lunch: ₹40-50/day = ₹800-1,000/month

Savings: ₹2,200-3,000/month = ₹26,400-36,000/year!

5. Government Schemes

- Jan Dhan: Free account + ₹2L accident insurance

- Ayushman Bharat: Free ₹5L health insurance (check eligibility)

- Garib Kalyan: Free ration (saves ₹500-800)

- Sukanya Samriddhi: High interest for girl child

- PPF: Tax-free returns

- Awas Yojana: Home loan subsidy

Check: myscheme.gov.in

6. Side Hustle (₹3,000-10,000/month extra)

Low skill: Uber/Ola, delivery, tutoring, homemade items

Medium skill: Freelancing (Fiverr), online teaching

High skill: Consulting, app development

7. Expense Tracking

Apps: Walnut, Money Manager, ET Money

Result: Save 10-20% (₹2,000-6,000/month) just from awareness!

8. Generic Brands

- Jan Aushadhi medicines (50-90% cheaper, SAME quality)

- Local brands groceries (often same source!)

- Local tailors (₹500 vs ₹2,000 shirt)

Savings: ₹2,000-5,000/month

9. Joint Family Cost-Sharing

Method:

- Calculate total household expenses

- Divide proportionally by income or equally

- Monthly transfer to household account

10. Auto-Save First

- Salary credited 1st

- Auto-debit 2nd (before you see it!)

- Live on what’s left

Psychology: Can’t spend what you don’t see

Investment Options

Safe & Guaranteed (40-50% savings):

1. PPF

- Return: 7.1% tax-free

- Lock: 15 years

- Investment: ₹500-₹1.5L/year

- Tax benefit: Yes

2. EPF

- Return: 8.15%

- Automatic for salaried

- Retirement corpus

3. FD

- Return: 6-7%

- Lock: Flexible

- Very safe

- Emergency fund

4. Senior Citizen Savings

- Return: 8.2%

- Age: 60+

- Lock: 5 years

5. Sukanya Samriddhi

- Return: 8.2% tax-free

- Girl child under 10

- Lock: Till 21

- Investment: ₹250-₹1.5L/year

Market-Linked (30-40% savings):

6. Mutual Funds SIP

- Return: 10-15% long-term (varies)

- Risk: Moderate-high

- Start: ₹500/month

- Apps: Groww, Zerodha, ET Money

How to start:

- Start small

- Diversify (2-3 funds)

- SIP (discipline!)

- Long-term (5+ years)

7. Equity/Stocks

- High risk

- Learn first

- Small start

- Diversify

Physical Assets (10-20%):

8. Gold

- Sovereign Gold Bonds (best!)

- 2.5% interest + price appreciation

- Tax-free

9. Real Estate

- Long-term

- Rental income

- Illiquid

- Research thoroughly

Financial Planning by Life Stage

Young Couple (25-35)

Priorities:

- Emergency fund (6 months)

- Term life insurance

- Health insurance (₹5L minimum)

- Start SIPs (₹2,000-5,000)

- Avoid debt (except home)

Investments:

- 70% equity

- 20% safe (PPF)

- 10% liquid (FD)

Parents with Children (35-55)

Priorities:

- Children’s education fund

- Retirement planning

- Insurance adequate

- Home loan repayment

- Emergency fund

Investments:

- 50% equity

- 30% safe

- 20% education-specific

Education: ₹5,000/month SIP 18 years = ₹35-45L

Pre-Retirement (55-60)

Priorities:

- Debt-free

- Retirement corpus finalized

- Health insurance adequate

- Shift to safer investments

Investments:

- 30% equity

- 50% safe

- 20% liquid

Retirement (60+)

Priorities:

- Regular income

- Medical fund

- Capital preservation

- Estate planning

Investments:

- 20% equity

- 60% safe income

- 20% ultra-liquid

Government Financial Schemes

- Jan Dhan: Zero-balance account + insurance

- Ayushman Bharat: ₹5L free health insurance

- Garib Kalyan: Free ration

- Atal Pension: ₹1,000-5,000 pension after 60

- Awas Yojana: Home loan subsidy

- Mudra: Business loan up to ₹10L

Check all: myscheme.gov.in or UMANG app

Common Financial Mistakes

1. No Emergency Fund Solution: Build 6 months expenses

Example: ₹30,000/month = ₹1.8L minimum

2. Inadequate Insurance Solution:

- Health: ₹5-10L minimum

- Term life: 10-15x annual income

3. Lifestyle Inflation Problem: Salary up → Expenses up → No savings growth

Solution: Save 50% increment

₹40k → ₹50k: Save ₹5k, spend ₹5k extra

4. Not Teaching Children Money Solution:

- Pocket money (budgeting)

- Savings account (saving)

- Budget discussions (age-appropriate)

- Small mistakes early (learning!)

5. Money Idle Problem: Lakhs in savings 3% while inflation 6% = losing money!

Solution:

- Emergency in liquid FD (6%)

- Medium-term in debt funds/PPF (7-8%)

- Long-term in equity (10-15%)

6. Borrowing for Lifestyle Solution:

- Save first, spend later

- 24-hour rule

- If can’t afford cash, can’t afford credit

Financial Action Plan

This Month: □ Calculate expenses

□ Create 50-30-20 budget

□ Expense tracking app

□ Open accounts

□ Check scheme eligibility

3 Months: □ ₹10,000-20,000 emergency starter

□ Auto-debit savings

□ Optimize expenses

□ Get health insurance

□ Start ₹500 SIP

6 Months: □ Emergency = 2-3 months expenses

□ All debt except home paid

□ Savings habit established

□ Insurance in place

1 Year: □ Emergency = 6 months!

□ Saving 20% consistently

□ Investments started

□ Budget autopilot

□ Financial stress reduced

PART 4: OCEAN Personality - Your Family’s Secret Code

🧬 Why Personality Matters

Example:

Husband frustrated wife “wastes money” eating out.

Wife resents husband is “boring” and “cheap.”

Reality: He’s High C (conscientious, budgets strictly). She’s High E (extroverted, needs social connection).

Without understanding: Endless fights.

With understanding: “His personality needs financial control. Mine needs social connection. Let’s budget ₹3,000/month for my social needs. I’ll stick to it, he’ll relax.”

Result: Conflict resolved!

This is personality’s power.

The OCEAN Model

THE most scientifically validated personality framework.

O - Openness to Experience

C - Conscientiousness

E - Extraversion

A - Agreeableness

N - Neuroticism

Everyone has all five, just at different levels (high/medium/low).

O - OPENNESS

Measures: Creativity, curiosity, new experiences

High Openness:

- Creative, imaginative

- Loves new experiences

- Questions traditions

- Variety > routine

Money: Tries new investments, experiences over possessions, may take risks

Indian context: May clash with traditional expectations

Low Openness:

- Practical, traditional

- Prefers familiar

- “Why fix what isn’t broken?”

- Routine > variety

Money: Conservative (FD, PPF, gold), risk-averse

Indian context: Fits traditional expectations well

In Families:

High O parent + Low O child: Balance exposure without pressure

Low O parent + High O child: Give space within boundaries

C - CONSCIENTIOUSNESS (The Money Trait!)

Measures: Organization, discipline, reliability

High C:

- Super organized

- Detail-oriented

- Plans everything

- Follows through

Money: ⭐ BUDGETING CHAMPION!

- Tracks every rupee

- Excel sheets

- Never misses savings

- Bills paid early

Relationship: Reliable, keeps promises

Low C:

- Spontaneous, flexible

- Goes with flow

- Last-minute

- Messy/disorganized

Money: 💸 WHERE DID SALARY GO?!

- Forgets to save

- No budget

- Late payments

- Impulse spending

Relationship: Fun, spontaneous, forgets anniversaries

Financial Strategies:

High C:

- YOU manage family budget

- Your superpower!

- But allow some flexibility

Low C:

- AUTOMATE EVERYTHING!

- Auto-debit before you see money

- Apps that do it for you

- Hide money (PPF 15-year lock!)

- Ask High C for help

- Keep SIMPLE

Marriage:

- High C + High C = Easy financial harmony

- High C + Low C = High C handles money (can work!)

- Low C + Low C = DANGER! Automatic systems needed!

E - EXTRAVERSION

Measures: Energy source - people or alone time

CRITICAL: Extraversion ≠ shy/confident!

High E (Extroverts):

- Talkative, outgoing

- Energized by people

- Life of party

Money:

- Spends on social life

- “Let’s celebrate!”

- Treating friends

Relationship: Needs social partner or understanding

Low E (Introverts):

- Quiet, reserved

- Energized by alone time

- Few close friends

Money:

- Saves more! (less socializing)

- Happy at home

- Content with few purchases

Relationship: Deep one-on-one, needs alone time

Financial Strategies:

High E:

- Set “social budget” (₹3,000-5,000)

- Track separately

- Suggest free activities

- Host potlucks vs restaurants

- “Let me check budget”

Low E:

- You naturally save more!

- Don’t let pressure to socialize

- Invest social budget elsewhere

- But maintain SOME connection

A - AGREEABLENESS (The Boundary Trait)

Measures: Kindness vs directness

High A:

- Kind, helpful

- Cooperative

- Trusting

- Conflict-avoidant

Money: 💔

- Lends easily (doesn’t get back!)

- Helps everyone (at own expense)

- Can’t say no

- “They need it more”

Relationship: Very caring, adjusts constantly

Low A:

- Direct, blunt

- Competitive

- Skeptical

Money: 💪

- Can say NO

- Protects savings

- “My money, my rules”

- Strong boundaries

Relationship: Honest (sometimes brutally)

CRITICAL for High A:

You CAN Say NO!

Scripts for loan requests:

- “I’d love to help, but finances committed right now”

- “I’m not in position to lend currently”

- “My savings are for emergency fund, can’t risk it”

- “Let me help research other options”

Money Boundaries:

- Only lend what you can afford to LOSE

- If can’t afford to lose it, CAN’T lend it

- Family doesn’t entitle them to your money

- Your savings = your security (NON-NEGOTIABLE!)

- Being kind ≠ being doormat

Your heart is gold. Protect your wallet.

N - NEUROTICISM (Emotional Stability)

Measures: How you experience negative emotions

High N (Lower Stability):

- Worries a lot

- Moody

- Anxious

- Sensitive to stress

Money: 😰

- Over-saves from fear

- Constantly worried

- Checks balance repeatedly

- “What if disaster?”

Relationship: Needs reassurance, fears abandonment

Indian context: “Log kya kahenge” anxiety on steroids

Low N (Higher Stability):

- Calm, stable

- Confident

- Stress-resistant

Money:

- Relaxed about finances

- “It’ll work out”

- Rational decisions

Relationship: Secure, doesn’t overthink

Indian context: “Sab theek ho jayega,” family’s rock

Strategies for High N:

Anxiety Relief:

- Build 6-month emergency fund → MASSIVE peace of mind!

- Automate finances → fewer decisions

- Therapy → not weakness, STRENGTH!

- Meditation daily (10 min)

- Exercise regularly

- Limit news/social media

- Gratitude practice

Money Anxiety:

- Your worry is VALID

- BUT: Build systems

- Emergency fund removes 80% anxiety

- Once built, STOP worrying

- Redirect energy to planning

Applying OCEAN to Your Family

Family Personality Mapping

Step 1: Everyone takes OCEAN test

Free: TruityTest.com, 123test.com, PersonalityAssessor.com

Time: 10-15 min

Answer: HONESTLY

Step 2: Share results (family meeting)

- No judgment!

- Each explains scores

- Discuss surprises

Step 3: Understanding Exercise

Each person: “I’m High/Low in [trait]. I need [X] from family”

Example: “I’m High N, so I need reassurance when anxious, not ‘stop worrying’”

Step 4: Apply to daily life

Financial decisions:

- High C leads budgeting

- Low C follows systems

- High A needs protection from loans (Low A supports)

Social planning:

- High E plans outings (respects Low E limits!)

- Low E communicates alone time needs

Personality + Parenting

High C child:

- Naturally organized, studies well

- DON’T micromanage

- DO encourage relaxation (“mistakes okay”)

- Risk: Perfectionism, burnout

Low C child:

- Disorganized, last-minute

- DON’T just nag!

- DO create systems (checklists, reminders)

- Risk: Academic struggles

High E child:

- Many friends, can’t sit still

- DON’T suppress!

- DO channel (sports, clubs)

Low E child:

- Few friends, quiet

- DON’T force socializing!

- DO respect nature

- “Why so quiet?” is hurtful!

High A child:

- Kind, helpful

- Risk: Bullied, taken advantage of

- TEACH boundaries early!

High N child:

- Worries about exams, anxious

- DON’T dismiss (“Don’t worry!”)

- DO validate (“I understand. Let’s plan together”)

- Support: Reassurance, therapy if needed

PART 5: Relationships & Family Harmony

Understanding Healthy vs Toxic

Green Flags (Healthy):

✅ Equal effort

✅ Mutual respect

✅ Trust

✅ Support

✅ Growth together

✅ Open communication

✅ Financial transparency

✅ Conflict resolution

✅ Independence

✅ Genuine apologies

✅ Physical/emotional safety

Red Flags (Toxic) - LEAVE:

🚩 Controlling

🚩 Financial abuse

🚩 Isolation

🚩 Violence (any form)

🚩 Dowry demands

🚩 Constant criticism

🚩 No boundaries

🚩 Gaslighting

🚩 Threats

🚩 Jealousy/possessiveness

🚩 Blames you

🚩 Walking on eggshells

If multiple red flags: This is abuse. Safety plan needed. Call 181.

Managing In-Laws & Extended Family

Response Scripts

Unsolicited Parenting Advice:

Them: “You shouldn’t feed baby like that!”

You: “Thank you for sharing, Auntyji! Our pediatrician recommended this. We’re trying it first. If we need guidance, we’ll come to you!” (Acknowledge + Redirect + Honor)

Pressure to Quit Job:

Them: “Now married, you should leave job.”

You: “My career is important for financial security and personal fulfillment. [Husband’s name] and I manage home beautifully together. We’re happy with our arrangement.” (United front + boundary)

Privacy Invasion:

Them: Enters bedroom without knocking, checks phone

You: “We appreciate living together. We also need private couple time. We’ll take evening walks alone. Thank you for understanding!” (Positive + boundary)

Dowry Demands (Post-Marriage):

Them: “Your family should give us [car/money].”

You: “Dowry is illegal under Dowry Prohibition Act 1961. We won’t entertain these requests. If continues, we’ll take legal action.” (Clear, firm, legal)

Then: Document, inform family, consult lawyer, report

Comparison:

Them: “Sharma ji’s daughter-in-law cooks 10 dishes daily!”

You: Smile “Every family is unique. We’re doing what works for us. We’re both happy!” (Don’t defend, don’t engage, state contentment)

United Front Rule

CRITICAL: Each partner sets boundaries with THEIR family!

Husband’s family → Husband addresses

Wife’s family → Wife addresses

Never cross-manage!

Privately: Decide together

Publicly: “WE have decided…”

Communication Scripts

Starting Difficult Conversation:

“I need to talk about something important. When’s a good time? I need 20 minutes focused attention.”

Expressing Feeling:

Wrong: “You ALWAYS forget anniversary! You don’t care!”

Right: “I feel hurt when anniversaries aren’t acknowledged. It makes me feel unvalued. Anniversaries are important to me. Can we discuss celebrating them?”

(I-statement, specific, solution-oriented)

Setting Boundary:

“I love you and value our relationship. I’m also feeling overwhelmed. I need [specific boundary]. This isn’t about you, it’s about my capacity. Can we work together?”

(Reassurance + boundary + collaboration)

12 Non-Negotiables When Choosing Partner

For Arranged Marriage:

- Respects your family

- Supports your career/education

- Financial transparency, NO dowry

- Emotionally mature

- Can set boundaries with own family

- Treats you as equal

- Good communicator

- Similar life goals

- Trustworthy and honest

- Controls anger well

- Views marriage as partnership

- Will stand up for you when needed

Even ONE violated? Think very carefully.

Emergency Domestic Violence Protocol

Immediate Danger:

- Get to safe place

- Call 181 or 100

- Nearest women’s police station

- Preserve evidence (photos, messages)

Safety Planning:

- Important documents with trusted person

- Emergency cash hidden

- Emergency bag at friend’s

- Safe contacts memorized

- Know police station location

Legal:

- File FIR

- Protection order (court, free)

- Contact DLSA (free lawyer)

- Section 498A IPC

- DV Act 2005

Shelters:

- Swadhar Greh

- NGO shelters (NCW 7827-170-170)

Remember: Abuse is NEVER your fault. You deserve safety.

PART 6: Complete Action Plans & Resources

🎯 90-Day Family Transformation

Month 1: Foundation (Weeks 1-4)

Week 1: Assessment □ Everyone completes 8-dimension assessment

□ Family meeting share results

□ Identify top 3 priorities

□ Set 90-day goals

Week 2: Financial Foundation □ Track ALL expenses

□ Calculate income vs expenses

□ Create 50-30-20 budget draft

□ Check scheme eligibility

Week 3: Health Baseline □ Schedule check-ups

□ Start daily 20-min walk

□ Begin water tracking

□ Set consistent bedtime

Week 4: Relationship & Mental □ Daily family gratitude (3 things)

□ Screen-free dinner

□ 15-min couple time weekly

□ Research therapy if needed

Month 2: Implementation (Weeks 5-8)

Week 5-6: Priority #1

If Financial: □ Implement budget

□ Auto-debit savings

□ Expense tracking app

□ Cut one subscription

□ Start ₹500 SIP

If Physical: □ Morning yoga 15 min

□ Pack lunch 3x/week

□ Eliminate one junk food

□ Sunday meal prep

If Mental: □ Daily 10-min meditation

□ Started therapy if needed

□ Limit social media 30 min

□ Weekly digital detox

Week 7-8: Priority #2 (Continue Week 5-6 + add new focus)

Month 3: Integration (Weeks 9-12)

Week 9-10: Priority #3 (Continue previous + add third)

Week 11: Integration □ Review all habits

□ Adjust what’s not working

□ Celebrate wins!

□ Retake assessment

Week 12: Planning □ Compare scores

□ Identify next priorities

□ Family meeting: What worked?

□ Plan next quarter

📋 Daily/Weekly/Monthly/Yearly

Daily (20 min)

Morning (10 min): □ Wake same time

□ 2 glasses water

□ 5-min family yoga

□ Healthy breakfast

Evening (10 min): □ 20-min walk

□ Screen-free dinner

□ Share high and low

□ Gratitude (3 things)

□ Consistent bedtime

Weekly (2-3 hours)

Sunday: □ Wellness meeting (30 min)

□ Meal prep (1 hour)

□ Outdoor activity (1 hour)

Wednesday: □ Financial check (15 min)

□ Relationship check (15 min)

Friday: □ Social connection (30 min)

Saturday: □ Fun day!

Monthly (1-2 hours)

First Sunday: □ 8-dimension quick check

□ Budget review

□ Relationship health

□ Physical check (weight)

□ Plan month ahead

□ Try new recipe

□ Declutter one area

Yearly (Half day)

Every January:

Assessment: □ Full 8-dimension (everyone)

□ Compare to previous year

□ Celebrate improvements

□ Identify challenges

Health: □ Health check-up everyone

□ Dental

□ Eye test

□ Update vaccinations

□ Review insurance

Financial: □ Net worth calculation

□ Review/adjust budget

□ Emergency fund adequate?

□ Review investments

□ Update nominees

□ Tax planning

Relationships: □ Family bonding better/worse?

□ Relationships needing repair?

□ Marriage check-in (rate 1-10)

Goals: □ Review previous year’s goals

□ Set new year’s goals

□ Individual goals

📚 Comprehensive Resources

Mental Health

Emergency (24/7, Free):

- Vandrevala: 1860-2662-345

- iCall: 9152987821 (Mon-Sat 8am-10pm)

- NIMHANS: 080-46110007

- Sneha: 044-24640050

Therapy: BetterLYF, YourDOST, MindPeers, Practo

Apps: Wysa, InnerHour, Headspace, Calm

Physical Health

Government:

- Ayushman Bharat: 14555

- Jan Aushadhi: janaushadhi.gov.in

Apps: HealthifyMe, Cult.fit, Practo, 1mg

Emergency:

- Ambulance: 108/102

- Medical: 112

- Poison: 1800-118-111

Legal Aid & Safety

Helplines:

- Women: 181 (24/7)

- Domestic Violence: 1091

- Child: 1098

- Senior Citizen: 1800-180-1253

- NCW: 7827-170-170

Legal:

- DLSA (every district, free)

- NALSA: nalsa.gov.in

- Women’s Commission (state level)

Financial

Government:

- MyScheme.gov.in

- UMANG app

Apps:

- Walnut, Money Manager (expense)

- Groww, Zerodha, ET Money (invest)

- CRED (bills)

❓ Top 20 FAQs

Q: Do we need to work on ALL 8 dimensions? A: No! Start with lowest 2-3. Small improvements in multiple areas > perfection in one.

Q: We tried before and failed. Why will this work? A: Too ambitious before. This: tiny habits (10 min), family accountability, personality-based. Start ONE habit.

Q: ₹20,000 income. Can we save? A: YES! Government schemes + home cooking + generics + bulk buying. Even ₹1,000/month = ₹12,000/year!

Q: Spouse keeps lending money to relatives. A: Create “Lending Budget” (₹2-3k/month). Exhausted? “Budget done, revisit next month.” Main savings need both signatures.

Q: Toxic relationship or rough patch? A: Rough: Both want to fix, temporary stress, respect remains. Toxic: One-sided, chronic disrespect, fear. Walking on eggshells = toxic.

Q: “Log kya kahenge” anxiety. A: People talk regardless. Their opinions don’t pay bills. In 5 years, they’ll gossip about someone else. Your mental health > approval.

Q: Can personality change? A: Core stays (50% genetic). Behaviors can shift 10-20%. Don’t change personality, work WITH it!

Q: Low C child affects studies. A: Don’t change personality. Build systems: checklists, alarms, organized space, short sessions. External structure compensates!

Q: Is therapy only for “crazy people”? A: NO! Therapy = gym for mind. For tough times, growth, stress management. Stigma is outdated.

Q: Can’t afford therapy. A: Free: college, workplace EAP, government clinics, helplines. Affordable: sliding scale, online (₹500-1000), apps (Wysa free).

Q: In-laws interfere constantly. A: Acknowledge + Redirect: “Thank you for concern, Auntyji. We’ve decided to try [X]. If we need guidance, we’ll come to you!”

Q: How do I set boundaries without being “disrespectful”? A: United front (each manages their family). Respectful tone, firm content. “We appreciate you. We also need [boundary]. Thank you for understanding.”

Q: Healthy food is boring. A: Indian cuisine is flavorful! Use spices, herbs, garlic, ginger, lemon, small amount ghee. Method matters (grilled/roasted > fried).

Q: Joint family, can’t eat differently. A: Modify portions (same food, less roti, more sabzi). Add on side (salad, dal). Frame medically if needed.

Q: Parents refuse to exercise. A: Doctor prescribes (authority!). “Papa, I need company for walk.” Show peer examples. Make it easy (video ready). Lead by example.

Q: Meditation recommended but I can’t sit still. A: Many forms! Walking meditation, yoga, mindful eating/showering, coloring. Even 1 minute breathing. Find YOUR way.

Q: Screen time ruining family health. A: Family policy (everyone follows!): Screen-free zones (dining, bedrooms), times (meals, 1 hour before bed). Phone parking basket. Provide alternatives!

Q: How to save for festivals? A: Festival jar! Calculate yearly expenses, divide by 12, save monthly. Ready when festival comes!

Q: Best investment for beginners? A: Start: Emergency fund (FD), PPF (safe), ₹500 SIP (Groww). Learn gradually. Diversify.

Q: High A - how to say no to loan requests? A: “I’d love to help, but finances committed.” “Not in position to lend currently.” “Let me help research other options.” Only lend what you can LOSE!

CLOSING: Your Family’s New Beginning

💫 Key Takeaways

The Non-Negotiables:

- Holistic Approach - All 8 dimensions interconnected

- Small Daily Actions - 10 min daily > 2-hour monthly

- Family Unity - Succeed or struggle together

- Cultural Context - Honor tradition + embrace change

- Personality Awareness - Understanding reduces 80% conflicts

- Financial Foundation - Money stress kills wellness

- Relationships First - Wealth without relationships = poverty

- Mental Health Matters - Real, valid, treatable

- Seek Help Early - Professional support = strength

- Progress Not Perfection - 70% consistency = success

🌺 Your Family Wellness Commitment

We, the __________ family, commit to:

Physical: □ 30 min daily activity

□ Home-cooked meals 5-6 days

□ 7-8 hours sleep

□ Annual check-ups

Mental: □ Daily stress management

□ Safe emotional expression

□ Professional help when needed

□ No stigma

Spiritual: □ Daily gratitude

□ Regular spiritual practice

□ Living values

□ Finding meaning

Intellectual: □ Continuous learning

□ Curiosity encouraged

□ Creative expression

□ Engaging conversations

Social: □ Quality family time daily

□ Maintaining relationships

□ Community engagement

□ Support systems

Occupational: □ Purpose in work

□ Work-life balance

□ Career growth support

□ Respecting all contributions

Financial: □ 50-30-20 budget

□ Emergency fund building

□ Save before spending

□ Financial literacy

Environmental: □ Clean organized home

□ Nature time weekly

□ Sustainable practices

□ Clutter management

Communication: □ Weekly wellness meetings

□ Open honest conversations

□ Boundaries respected

□ Conflicts resolved with kindness

Support: □ Celebrate wins

□ Support during struggles

□ No judgment, only love

□ Seek help together

Signed: _____

**Date:** _________

🙏 Final Blessing

Dear Beautiful Family,

You’ve reached the end of this guide, but the beginning of your wellness journey.

Remember:

🌺 Perfection isn’t the goal - Progress is

🌺 You’re not alone - Millions face these challenges

🌺 Never too late - 15 or 75, start today

🌺 Small actions compound - 10 min daily = 60+ hours yearly

🌺 Your family is unique - Customize to YOUR needs

🌺 Challenges will come - Face them together

🌺 Love is foundation - All strategies mean nothing without it

🌺 You deserve thriving - Not just surviving, THRIVING

May your home be filled with:

💚 Laughter echoing

💚 Love deepening

💚 Understanding bridging

💚 Prosperity from wisdom

💚 Health sustaining

💚 Peace settling

💚 Purpose guiding

💚 Gratitude coloring

💚 Resilience carrying

💚 Joy making life worth living

🚀 Start Today. Start Small. Start Together.

Pick ONE thing. Just ONE.

Maybe:

- 10-min family yoga tomorrow

- Auto-debit savings today

- OCEAN test this evening

- Honest conversation tonight

- Call parents “I love you”

- Cook healthy meal this week

- Start festival jar ₹500

Just. Start.

Your future family is counting on present you.

Make them proud. 💪

Namaste. Khuda Hafiz. Sat Sri Akal. Amen.

May peace, prosperity, and wellness be with you always. 🙏

Your wellness journey begins now. 🌺✨

Published: January 26, 2026

Version: 1.0

Reading Time: 90 minutes

Love Infused: Infinite 💕

END OF GUIDE